Visual Storytelling Through the Lens

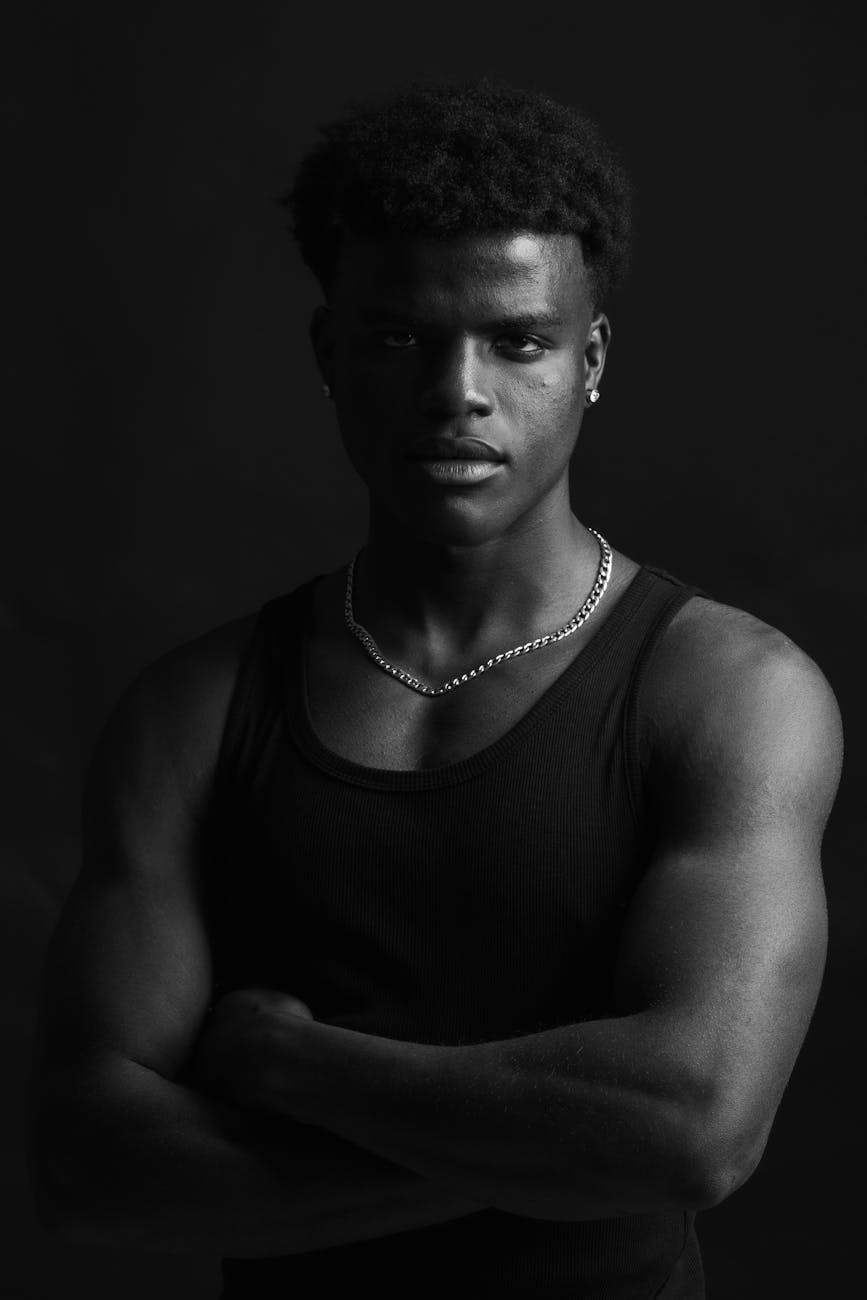

Creating timeless imagery that captures emotion, beauty, and authenticity

Creating timeless imagery that captures emotion, beauty, and authenticity

"Absolutely stunning work! The attention to detail and creative vision exceeded all our expectations. Highly recommend for any photography needs."

Marketing Director

"Professional, talented, and a pleasure to work with. The photos captured the essence of our brand perfectly. We couldn't be happier with the results."

Business Owner

"An incredible eye for composition and lighting. Every shot was magazine-quality. Will definitely be working together again on future projects."

Creative Director

Capturing moments through light and composition. Based in the city, working worldwide.

My journey into photography began over a decade ago with a simple film camera and an insatiable curiosity about how light shapes our perception of the world. What started as a hobby quickly evolved into a passion, and eventually, a full-time career that has taken me across continents and into countless unique moments.

I specialize in portrait, landscape, and urban photography, with a particular focus on finding the extraordinary in everyday scenes. My work has been featured in numerous publications and exhibitions, and I've had the privilege of collaborating with diverse clients ranging from independent artists to international brands.

My approach is rooted in authenticity and connection. Whether I'm photographing a person, a landscape, or an architectural detail, I strive to capture not just what something looks like, but how it feels. I believe the best images are created through collaboration, patience, and a deep respect for the subject.

When I'm not behind the camera, you'll find me exploring new locations, studying the work of master photographers, or experimenting with alternative photographic processes. I'm constantly evolving my craft and pushing creative boundaries.

Let's create something beautiful together.